Credit card fraud prevention pdf

Credit Reference and Fraud Prevention Agencies to make decisions regarding your account including whether to make credit available or to confirm or extend credit.

1 37 Offering Fraud Prevention Service (ReD) for the Advance Detection of Credit Card Fraud ~To enable security measures for all phases from before through after payment~

Credit cards have significant fraud protection built in, but some payment methods don’t. Wiring money through services like Western Union or MoneyGram is risky …

FraudLabs Pro performs a comprehensive fraud validation on all elements such as geolocation, proxy, email, credit card, transaction velocity and others to unveil fraud orders accurately.

Fraudulent online credit card activity has surged dramatically in recent years. Without widespread merchant complacency and lack of awareness about how fraud works, this

Minimise credit card fraud Credit card fraud is a problem most small businesses fail to think about, until it hits them. If you sell online, or by mail, your business is potentially at risk of losing money from fraudulent credit card orders.

victims of card fraud24 and credit card fraud costs the U.K. more than £1 million a day. 25 As a result, the U.K. banking industry has actively sought to combat fraud.

The purpose of this workshop is to inform participants about credit card fraud, to promote prevention and provide useful information to victims of identity theft. By the end of the workshop, participants will understand:! the effects of credit card fraud! how credit card fraud is perpetrated ! how to recognize different types of deception! how to avoid becoming a victim of credit card fraud

prevention fails, we need effective detection of fraud, so that investigations can be undertaken, debts recovered and prosecutions initiated where appropriate. Our collective responsibility is to ensure fraud and business integrity risks are

Plastic card fraud is defined as using plastic payment cards, such as ATM, debit, credit or store cards to take money without permission or prior knowledge from a bank, building society or credit card …

With premium Fraud Management, Blackbaud Merchant Services generates a fraud score based on the likelihood of the credit card transactions being fraudulent. Those transactions with the greatest risk are assigned the highest scores.

credit card fraud prevention in nonprofits. table of contents fraudulent credit card transactions and in what ways charities are at risk card tumbling online auction fraud creation of clone charities processing suspicious transactions impact of credit card fraud targeted at nonprofits impact of credit card fraud for donors steps nonprofits can take to minimize their risks pci compliance and

Fraud Prevention for Merchants St.George Bank

ONLINE CREDIT CARD FRAUD PREVENTION Volusion

“The credit and debit card fraud category of financial services is among the fastest-growing and best-known means of criminal profit,” says Rodney Nelsestuen of TowerGroup. 7 “What makes card fraud of great concern is the fact

Credit card fraud can happen in a variety of ways, from low tech diving to high tech hacking. To overcome the limitations mentioned above, in this paper we have proposed an idea of using two techniques of biometric authentication.

carefully examined and new fraud prevention system is proposed which overcomes the flaws of the AVS technique. Credit card related frauds in online payments have increased rapidly. Many techniques have been designed to find ways to overcome credit card. Still no technique can provide solution for all types of fraud. As far as developing countries are concerned less work has been done to

ID Theft: When Bad Things Happen to Your Good Name Introduction How Identity Theft Occurs Minimize Your Risk What You Can Do Today Maintaining Vigilance

THE SMALL BUSINESS FRAUD PREVENTION MANUAL iv Small Business Fraud VI. CREDIT CARD SCHEMES (CONT.) Skimming….. 119

• credit card fraud • refund fraud • supplier fraud • card skimming • counterfeit notes • cheque fraud. Credit cards. With the introduction of chip technology and the increased use of PIN numbers rather than signatures the risks to retailers has declined over recent years. Customers may still choose to sign rather than use a PIN. If customers use a signature make sure this is

Dear Experian,I had my wallet stolen. My entire life was in my wallet including a check book, my Social… Experian released its sixth annual Data Breach Industry Forecast, with its data breach predictions for 2019. The latest cyber-threats:… How serious is the threat of retail-based data breaches

element, besides other fraud prevention tools, which enables a card accepting entity to evaluate the fraud risk in a given transaction. However, there are domestic or regional instances where a card scheme may grant the right to the

Fraud prevention is never being so easy with FraudLabs Pro, a sophisticated payment fraud detection solution to protect merchant from fraud losses and chargebacks. It helps merchants to minimize fraud and maximize the revenue.

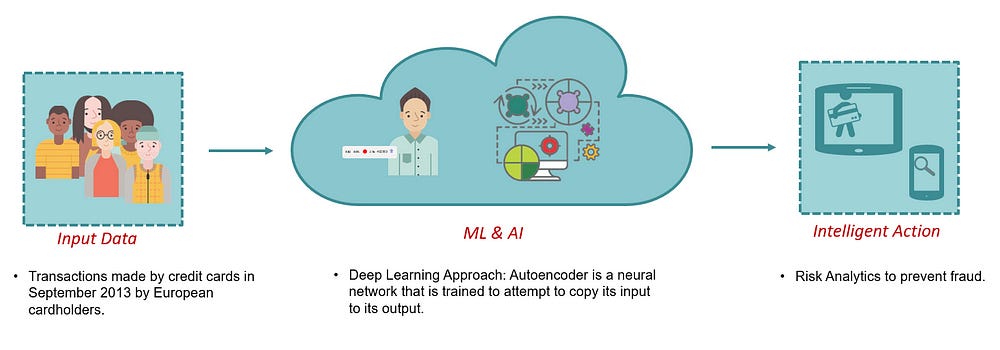

The actions taken against fraud can be divided into fraud prevention, which attempts to block fraudulent transactions at source, and fraud detection, where successful fraud transactions are identified a posteriori.

Fraud Detection in Credit Card Transactions: Classification, Risks and Prevention Techniques N.Sivakumar#1, Dr.R.Balasubramanian*2 #1Research Scholar, *2 Research Supervisor,

CNP Fraud as a Percentage of the Total Value of Card Fraud In 2013, the value of fraud perpetrated using cards issued inside the SEPA increased for CNP transactions but decreased across other transaction channels.

Recent global payment fraud statistics indicate the seriousness of the credit card fraud problem. In the United Kingdom, in 2009 alone, losses from plastic (debit and credit) card fraud according

A Credit Card Fraud is a transaction that is complete with your credit card by someone else. Credit card fraud happens when someone steals your credit card, credit card information, or Personal Identification Number

Fraud & Identity Theft Prevention Tips Important Information for You We’re providing the tips below to help you and your loved ones learn more about fraud and identity theft Please note: Down East Credit Union will never ask you to provide personal or account information via email. Steps to Prevent and Reduce the Risk of Fraud and Identity Theft What to do if your card is lost or stolen

Recent estimates by the Commonwealth Attorney General’s Department indicate that identity crime costs Australia upwards of .6 billion per year, with the majority (0m) lost by individuals through credit card fraud, identity theft and scams.

Skimming Prevention • Best Practices for Merchants • August 2009 The most common, least sophisticated of criminal elements, who use readily available, simple technology and direct access to consumer payment cards.

Recognise the most common types of fraud and get tips to keep your details safe. Computer threats Learn about everyday computer threats like phishing scams, spyware, adware, viruses, worms and Trojans – and find out how to avoid them.

detecting various credit card fraudulent transactions. A genetic algorithm is an evolutionary search and A genetic algorithm is an evolutionary search and optimisation technique that Mimics natural evolution to find the best solution to a problem.

• .55 billion credit card fraud worldwide in 2012 (U.S. Department of Justice), .56 billion in US (2011 Nilson Report) • trillion used for credit card and .5 trillion for debit card purchases in

Fraud prevention issuers’ best practices guide overall best defense today’s changing environment plays a large role in the increase of card fraud.

CREDIT CARD FRAUD PREVENTION Welcome to NYC.gov

Protect your business Merchants face various risks when accepting credit card transactions. This brochure has been developed to assist you to understand the types

Though fraud prevention mechanisms such as CHIP&PIN are developed, these mechanisms do not prevent the most common fraud types such as fraudulent credit card usages over virtual POS terminals or mail orders. As a result, fraud detection is the essential tool and probably the best way to stop such fraud types. In this study, classification models based on decision trees and support vector

Card fraud prevention is detailed in the Protecting business against credit card fraud guide (PDF 91KB) Protect your business from Online Card Fraud Online retail is growing rapidly and offers a powerful channel for small businesses to reach new customers and increase sales. – international regulations for preventing collisions at sea 1972 pdf Credit card fraud: awareness and prevention Design/methodology/approach – A range of recent publications in journals and information from internet web sites provide corroboration and details of how fraudsters are using credit cards to steal billions of dollars each year.

Rinky D. Patel, Dheeraj Kumar Singh,” Credit Card Fraud Detection & Prevention of Fraud Using Genetic Algorithm ”, International Journal of Soft Computing and Engineering ISSN: 2231-2307, Volume-2, Issue-6, January 2013 .

Australian Payment Cards 6 Scheme Credit, Debit and Charge Cards 9 Proprietary Debit Cards 11 Fraud Trends and Prevention 12 Online Card Fraud 13 Counterfeit / Skimming Fraud 17 Lost and Stolen Fraud 19 Overseas-Issued Cards 21 Cheques 23. 1 AUSTRALIAN PAYMENT CARD FRAUD 2018 Glossary Types of Fraud Card-not-present (CNP) fraud: occurs when valid card details are …

How to Help Prevent Fraud Merchant Services tips to help protect your business TD Canada Trust. All credit cards issued in Canada are designed with special security features to help deter counterfeiting and fraud. A fraudulent credit card transaction could involve an invalid account number, or the unauthorized use of a valid account number. One of the common types of fraud loss is due to

PDF On Jan 1, 2010, Rayhab Anwar and others published Online Credit Card Fraud Prevention System for Developing Countries.

Fact Sheet Financial Crime Risk Management Overview A Common Platform for Detection, Alert Intelligence, Case Management and Reporting Today, most fraud detection is handled in silos – each fraud investigator is focusing on one payment channel such as check fraud and debit/credit card fraud. Siloed business units and systems are a significant and growing problem as criminals increasingly

The Retailer Information Sheet is also available on the Retailer Hub www.bclcretailerhub.com For more information, please contact your BCLC Territory Manager or Lottery Support Hotline at 1-800-667-1649

(PDF) Online Credit Card Fraud Prevention System for

3. CREDIT CARD FRAUD 3.1 Credit Card Fraud definition The credit card fraud can be described as using someone’s credit card but without the knowledge of the owner or issuer of the

detection and prevention, worldwide credit card fraud [the Internet component] will represent .5 billion in losses [annually] by 2005. However, if merchants

If you want to prevent credit card fraud, then you need to know how credit card companies treat fraud, the procedures for dealing with it, and your rights and responsibilities when it comes to unauthorized charges.

When accepting sales, consider our fraud prevention checklist. It will help you identify potentially fraudulent transactions from stolen credit cards or accounts, and minimise the risk of chargebacks and claims of items not received.

Fraud Prevention for Merchants Protecting business against credit card fraud

CREDIT CARD FRAUD PREVENTION . Credit Card Fraud is a serious criminal matter that impacts millions of consumers around the world. What can we do to help make sure we are not victimized?

Best Practices in Fraud Prevention 24 ways to protect your company How well-protected is your company? No matter the type of business, the risk of fraud is always present. While you cannot predict why or when your organization may become a target, there is a lot you can do to reduce the opportunity for fraud. We have collected some of the “Best Practices” that our existing customers have

Credit Card Fraud Training Consumer Action

Fraud Prevention for Merchants BankSA

Online Credit Card Fraud Prevention IJSTE JOURNAL

Stopping card fraud in its tracks ACI Worldwide

Blackbaud Merchant Services Fraud Prevention Filters

Features Fraud Detection & Prevention Solution To Reduce

Guide to Credit Scoring Credit Reference and Fraud HSBC

prevention of high blood pressure pdf – 104. 3. Fraud Detection in Credit Card Transaction

Genetic algorithms for credit card fraud detection INASE

Offering Fraud Prevention Service (ReD) for the Advance

CREDIT CARD FRAUD PREVENTION A SUCCESSFUL PDF

Credit Card Duplication and Crime Prevention Using Biometrics

Guide to Credit Scoring Credit Reference and Fraud HSBC

Protect your business Merchants face various risks when accepting credit card transactions. This brochure has been developed to assist you to understand the types

Best Practices in Fraud Prevention 24 ways to protect your company How well-protected is your company? No matter the type of business, the risk of fraud is always present. While you cannot predict why or when your organization may become a target, there is a lot you can do to reduce the opportunity for fraud. We have collected some of the “Best Practices” that our existing customers have

prevention fails, we need effective detection of fraud, so that investigations can be undertaken, debts recovered and prosecutions initiated where appropriate. Our collective responsibility is to ensure fraud and business integrity risks are

Minimise credit card fraud Credit card fraud is a problem most small businesses fail to think about, until it hits them. If you sell online, or by mail, your business is potentially at risk of losing money from fraudulent credit card orders.

Credit card fraud can happen in a variety of ways, from low tech diving to high tech hacking. To overcome the limitations mentioned above, in this paper we have proposed an idea of using two techniques of biometric authentication.