Detection and prevention of frauds in auditing pdf

Launching an Antifraud and Corporate Responsibility Resource Center, to be located on the AICPA Web site, featuring news, tools, information and resources in fraud prevention, detection and deterrence.

The auditors’ duties for the prevention, detection and reporting of fraud, other illegal acts and errors is one of the most controversial issues in auditing. This paper reports the findings of a

Evaluation of roles of auditors in the fraud detection and investigation in Nigerian industries 1Mary Josiah, 1 engaging the services of auditors and that detection of fraud and errors is inevitable. And also, the case of fraud in these organizations is due to poor management, lack of internal auditors, poor internal control system and corruption. Based on these findings, it is recommended

governance, place a strong emphasis on fraud prevention, which may reduce opportunities for fraud to take place, and fraud deterrence, which could persuade individuals not to commit fraud because of the likelihood of detection

Course Description. In Fraud Prevention, Detection, and Audit, Marshall Romney provides a comprehensive look at every aspect of fraud. You’ll learn how to prevent fraud by understanding how to design procedures that make it more difficult to perpetrate, how to detect fraud by knowing what you’re supposed to be looking for, and how an auditor

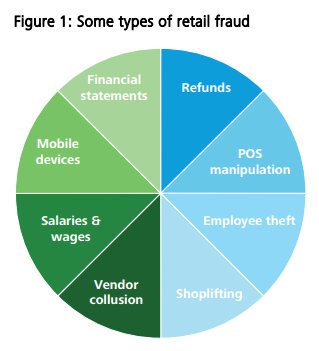

Fraud and corruption impacts negatively most organizations in terms of financials. As a threat to business, fraud must rank as one of the key risks to be managed.

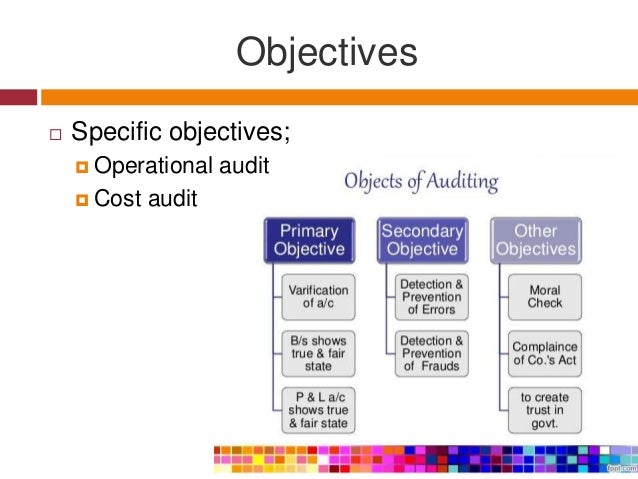

Auditing Detection and Prevention of Errors – Learn Auditing in simple and easy steps starting from basic to advanced concepts with examples including Introduction, Detection and Prevention of Fraud, Detection and Prevention of Errors, Basic Principles, Advantages, Limitations, Classifications, Preparation before an Audit, Audit Planning

What forensic auditing is and the role of forensic auditing in both internal and external audit Risk based auditing and the Audit Plan and the relationship between internal and external audit The importance of good corporate governance and counter-fraud activity and awareness

core internal audit features; internal audit size, internal audit quality and internal audit independence have a significant positive impact of financial fraud detection. Based on the

Challenges Facing Auditors in Detecting Financial Statement Fraud: Insights from Fraud Investigations Stephen K. Asare Arnie Wright Mark F. Zimbelman* INTRODUCTION Financial statement users and regulators expect external auditors to detect fraudulent financial reporting (fraud). For instance, in 2004, the PCAOB Chairman stated that, “detecting fraud is the responsibility of external …

• We can help determine whether Fraud Risks are completely identified, presented to the Audit Team to be addressed in a coordinated manner and tested in an efficient, effective manner. • We can address the concerns noted in the PCAOB 4010 report regarding fraud detection and

YouTube Embed: No video/playlist ID has been supplied

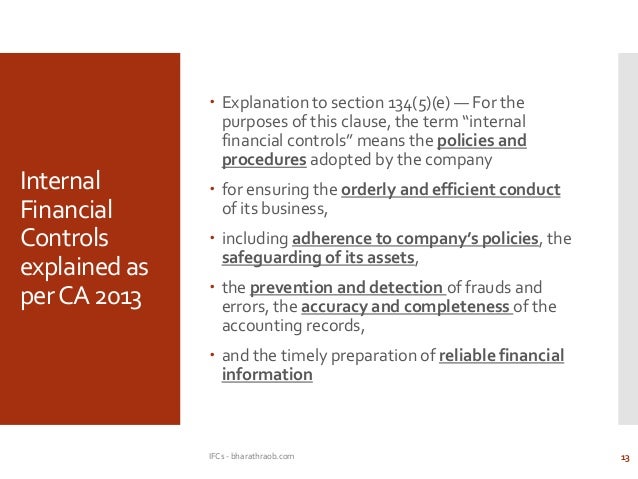

INTERNAL CONTROL AS THE BASIS FOR PREVENTION DETECTION

Challenges Facing Auditors in Detecting Financial

ineffective in the detection and prevention of the various types of frauds confronting businesses world-wide. Oyejide (2008) opine that fraud is a subject that has

Detection and prevention of Errors. Detection of material frauds and errors as an incidental objective of independent financial auditing flows from the main objective of

therefore, fraud prevention and detection is audit’s problem. The reality is that both management and audit have roles to play in the prevention and detection of fraud. The best scenario is one where management, employees, and internal and external auditors work together to combat fraud. Furthermore, internal controls alone are not sufficient, corporate culture, the attitudes of senior

Table 1 also shows the result of test for significance of the role of audit unit in fraud prevention and detection using chi square test. The guide is that the null hypotheses is accepted if the p- value is greater than 0.05 and reject the null hypotheses if p- value is less than 0.05. Therefore, from the table it shows that internal audit actually prevents and detects fraud in the hospital (p

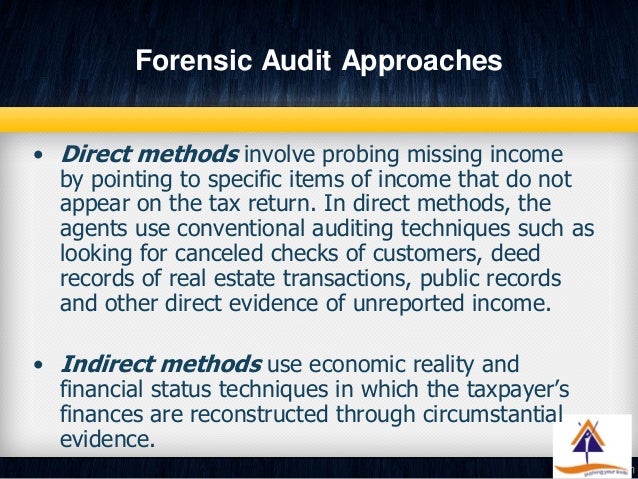

fraud prevention and detection. This may not be achieved by an auditor without some understanding of forensic This may not be achieved by an auditor without some understanding of forensic accounting methods (Effiong, 2012).

Auditing Detection and Prevention of Fraud – Learn Auditing in simple and easy steps starting from basic to advanced concepts with examples including Introduction, Detection and Prevention of Fraud, Detection and Prevention of Errors, Basic Principles, Advantages, Limitations, Classifications, Preparation before an Audit, Audit Planning

Investigating and detecting frauds in financial statements represent the primary task of an enterprise management and other controlling institutions (internal auditing, external auditing, audit committee, etc) and regulating bodies that should create proper normative framework

of internal auditing system of the organization in identifying the accounting frauds has lead to use of specialized procedures to detect financial accounting fraud, collective known as forensic accounting. Data mining techniques are providing great aid in financial accounting fraud detection, since dealing with the large data volumes and complexities of financial data are big challenges for

prevention and control. I hope the conference will delve in detail each of these aspects and come up with a set of workable solutions and recommendations on how to combat financial frauds and mitigate risks. I wish the conference a grand success. Thank You, Your Sincerely Sunil Kanoria President ASSOCHAM Financial and Corporate Frauds 3. Fraud is as an intentional and deliberate act to

prevention and detection in district treasuries in Kakamega County. The study recommends that effective and The study recommends that effective and efficient internal control policies and procedures should be put in place to prevent and detect fraud within

prevention and detection of fraud. Describes the inherent limitations of an audit in the context of fraud, and sets out the responsibilities of the auditor for detecting material misstatements due to fraud. Under this Auditing Standard: The auditor needs to maintain an attitude of professional scepticism recognising the possibility that a material misstatement due to fraud could exist

Fraud Prevention and Detection Internal audItInG and Fraud 2 / The Institute of Internal Auditors • Ongoing reviews — an internal audit activity that considers fraud risk in every audit and performs appropriate procedures based on fraud risk. • Prevention and detection — efforts taken to reduce opportunities for fraud to occur and persuading individuals not to commit fraud because

Forensic Accounting as a Tool for Detecting Fraud and Corruption: An Empirical Study in Bangladesh Md “A forensic audit’s purpose is the detection or deterrence of a wide variety of fraudulent activities.” In the article “Forensic Accounting in Indian Banks”, T R Shastri observes that while incidence of frauds, detection of frauds and the investigations before and after have been

9.6 The fraud prevention policy is supported by regular risk assessment and comprehensive education, training and awareness. 9.7 The fraud prevention policy is expressed in …

This study aims to provide an insight on the perception of bankers towards the effectiveness of fraud prevention and detection techniques in Malaysian Islamic banks.

prevention, detection and reaction to fraud that can enable you to perform financial statement audits with awareness of fraud possibilities. Chapter 2 defines and explains internal controls as they affect financial recordkeeping

forensic accounting as a tool for fraud detection and prevention in the public sector organizations with particular reference to Kogi State. Both primary and secondary sources of

engaging the services of auditors and that detection of fraud and errors is inevitable. And also, And also, the case of fraud in these organizations is due to poor management, lack of internal auditors,

detection of fraud rests with both those charged with governance of the company and management. It is important that those charged with governance and management place a strong emphasis on fraud prevention, which may reduce opportunities for fraud to take place, and fraud deterrence,

cha055130en01-14pp-fraud_guideline-or.doc – december 2014 – page 1 european court of auditors cead-a directorate december 2014 audit guideline on fraud

PDF This article aims to not just briefly describe the role of the internal audit in the detection of possible frauds, but also to highlight its importance in preventing the commission of frauds

fraud, types of fraud, and detection and investigation techniques applicable to fraud in corporate environment. A true history of fraud wo uld have to start in 300 B.C.,

AUDIT GUIDELINE ON FRAUD Select your language

The Impact of Forensic Accounting in Fraud Detection and Prevention: is because it is a more in-depth fact finding in specific area of concern than the regular audit. Fraud detection and prevention is a specific search to ascertain whether fraud took place or not to determine the extent of fraud perpetuated.Even though, allegations of fraud are often resolved through court action that may

490 Daniela Petraşcu and Alexandra Tieanu / Procedia Economics and Finance 16 ( 2014 ) 489 – 497 Nonetheless, we have used the method of documenting ourselves by analysing the rules regarding the internal audit

The fraud triangle, authored by Dr. Cressey, has been adopted by the auditing profession as a tool to help detect and deter occupational fraud. The model has many applications in the fraud audit. The primary purpose is in the planning stage to help identify where and why your organization would be vulnerable to someone committing a fraud risk scenario.

This article aims to not just briefly describe the role of the internal audit in the detection of possible frauds, but also to highlight its importance in preventing the commission of frauds …

total number of attempted frauds declined to 1193 in 2006 and increased again to 1553 in 2007. The experience in 2008 -2010 showed above 30% increment in the number of fraudulent attempts.

This course is for government staff responsible for eliminating waste, fraud, and abuse in programs and tasked with detecting and mitigating fraud risks.

Internal Audit’s Role in Fraud Prevention and Detection 1 WHITE PAPER Internal Audit’s Role in Fraud Prevention and Detection The Era of Fraud Scandals You did not hear a lot about fraud in the days before Enron, WorldCom, Tyco, and the Sarbanes-Oxley Act of 2002. Sure, occasionally a company would make the news because an employee in a fiduciary position embezzled funds or … – crime prevention approaches practices and evaluations 9th edition pdf Download bank frauds prevention and detection or read online books in PDF, EPUB, Tuebl, and Mobi Format. Click Download or Read Online button to get bank frauds prevention and detection book now. This site is like a library, Use search box in the widget to get ebook that you want.

Fraud detection and prevention is an invidious-arduous task. It is battle It is battle royal against the evil geniuses who are determined to render the systems of internal control incapable of

The Auditing and Assurance Standards Board (AUASB) makes this Auditing Standard ASA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of a Financial Report pursuant to section 227B of the Australian Securities and Investments Commission Act 2001 and section 336 of the Corporations Act 2001.

The auditor has no responsibility towards “detecting” fraud. The purpose of the audit is to determine whether the AFS present fairly in all material aspects of the …

Most financial executives are aware of the importance of having internal controls in fraud prevention and detection, yet few realize the potential fraud-based approaches have in finding complex fraud that is often overlooked by basic evidence of control measures.

Fraud and corruption risks are not sufficiently linked to internal audit programs. Without good identification of fraud and corruption risks facing an agency it is difficult to craft a fraud and corruption detection program to the actual risks faced.

That an auditor has the responsibility for the prevention, detection and reporting of fraud, other illegal acts and errors is one of the most controversial issues in auditing, and has been one of the most frequently debated areas amongst

Prevention/Detection Conduct a fraud risk assessment: One of the most effective ways to prevent fraud is to conduct a fraud risk assessment. This type of assessment will identify where and how fraud could occur, as well as who might be in

What are the auditor’s responsibilities for detection of

Audit for Fraud shows the auditor how to detect fraud. It does so by discussing fraud risk indicators and other clues indicating the presence of fraud and itemizes the many extended audit procedures that can be used to detect traces of fraud.

responsibility for prevention and/or detection of fraud rests upon management to develop adequate accounting systems with appropriate internal controls. This paper discusses the various facets of financial fraud, what constitutes auditors’

fraud prevention handbook Bilateral donor engagement in fighting corruption in South Africa: misuse of donor funds “In South Africa, there have been some high profile examples of the misuse of donor funds within civil society and the state

As reported by the Association of Certified Fraud Examiners 2016 Report to the Nations on Occupational Fraud and Abuse, organizations lose an average of 5% of their revenues to fraud. Yet, the report disclosed that only 3.8% of all frauds are detected by the external auditor. However, the thing that management depends on the detect fraud is the external audit.

Agreed with Waleed and Ayman. The Auditor’s role with respect to detection of errors and fraud is to ensure the following: 1. The assessment and identification of residual and inherent risk, control measures and mitigation of risk measures are in place (Compliance Assurance Program).

The IIA is here to help you feel safe and secure by providing access to a host of world-class fraud prevention, detection, and investigation resources. An IIA membership provides benefits that include exclusive savings and discounts on career and team development training at IIA-hosted events. When

The Auditor’s Responsibility to Detect Fraud

Financial Statement Fraud Prevention and Detection 2nd

Fraud auditing is creating an environment that encourages the detection and prevention of frauds in commercial transactions. In the broadest sense , it is an awareness of many components of fraud, such

When we discuss the issue of fraud prevention and detection related to the audit work, together with the underlying concepts, we must, first, clarify the types of fraud and audit we are referring to.

Auditing Detection and Prevention of Errors

Internal auditing and fraud Kingston City Group (KCG)

Auditing Detection and Prevention of Fraud

Fraud and Corruption Auditing Detection Prevention and

https://en.m.wikipedia.org/wiki/Fraud

Fraudulent Activities and Forensic Accounting Services of

– An Assessment of the Role of External Auditor in the

Fraud Auditing Detection & Prevention Blog Fraud Detection

Audit Fraud| Fraud Detection & Fraud Prevention| Audit CPE

YouTube Embed: No video/playlist ID has been supplied

Pages Fraud

Fraud in Government Prevention and detection lwm-info.org

Internal auditing and fraud Kingston City Group (KCG)

therefore, fraud prevention and detection is audit’s problem. The reality is that both management and audit have roles to play in the prevention and detection of fraud. The best scenario is one where management, employees, and internal and external auditors work together to combat fraud. Furthermore, internal controls alone are not sufficient, corporate culture, the attitudes of senior

The auditors’ duties for the prevention, detection and reporting of fraud, other illegal acts and errors is one of the most controversial issues in auditing. This paper reports the findings of a

Auditing Detection and Prevention of Errors – Learn Auditing in simple and easy steps starting from basic to advanced concepts with examples including Introduction, Detection and Prevention of Fraud, Detection and Prevention of Errors, Basic Principles, Advantages, Limitations, Classifications, Preparation before an Audit, Audit Planning

Course Description. In Fraud Prevention, Detection, and Audit, Marshall Romney provides a comprehensive look at every aspect of fraud. You’ll learn how to prevent fraud by understanding how to design procedures that make it more difficult to perpetrate, how to detect fraud by knowing what you’re supposed to be looking for, and how an auditor

That an auditor has the responsibility for the prevention, detection and reporting of fraud, other illegal acts and errors is one of the most controversial issues in auditing, and has been one of the most frequently debated areas amongst

Most financial executives are aware of the importance of having internal controls in fraud prevention and detection, yet few realize the potential fraud-based approaches have in finding complex fraud that is often overlooked by basic evidence of control measures.

Fraud and corruption impacts negatively most organizations in terms of financials. As a threat to business, fraud must rank as one of the key risks to be managed.

responsibility for prevention and/or detection of fraud rests upon management to develop adequate accounting systems with appropriate internal controls. This paper discusses the various facets of financial fraud, what constitutes auditors’

Forensic Accounting as a Tool for Detecting Fraud and Corruption: An Empirical Study in Bangladesh Md “A forensic audit’s purpose is the detection or deterrence of a wide variety of fraudulent activities.” In the article “Forensic Accounting in Indian Banks”, T R Shastri observes that while incidence of frauds, detection of frauds and the investigations before and after have been

engaging the services of auditors and that detection of fraud and errors is inevitable. And also, And also, the case of fraud in these organizations is due to poor management, lack of internal auditors,

fraud prevention handbook Bilateral donor engagement in fighting corruption in South Africa: misuse of donor funds “In South Africa, there have been some high profile examples of the misuse of donor funds within civil society and the state